No surge Bitcoin price after SEC approval exchange-traded Bitcoin funds

On Thursday, little movement was observed in the Bitcoin price. The much-anticipated approval by the…

The post No surge Bitcoin price after SEC approval exchange-traded Bitcoin funds first appeared on Crypto Beat News.

On Thursday, little movement was observed in the Bitcoin price. The much-anticipated approval by the U.S. Securities and Exchange Commission (SEC) for the introduction of exchange-traded Bitcoin funds was thus met with a lukewarm response from investors in the world’s largest cryptocurrency.

On Wednesday, it was announced by the regulator that approval had been granted for the introduction of exchange-traded Bitcoin funds, also known as Bitcoin ETFs. This decision makes the cryptocurrency more accessible to a broader group of investors. Investors are no longer required to purchase and store Bitcoins in a digital wallet. Instead, they are offered the opportunity to invest indirectly in Bitcoin.

Yesterday, the securities regulator approved the 19b-4 applications of ARK Invest & 21Shares, Bitwise, Invesco Galaxy, WisdomTree, Valkyrie, BlackRock, VanEck, Fidelity, Hashdex, Franklin Templeton, and Grayscale.

No Bitcoin endorsement after approval exchange-traded Bitcoin funds

“Although we have approved the listing and trading of certain Bitcoin ETFs, we have not approved or recommended Bitcoin itself,” SEC Chairman Gary Gensler stated in a declaration. “Investors should remain cautious regarding the numerous risks associated with Bitcoin and products whose value is linked to crypto.”

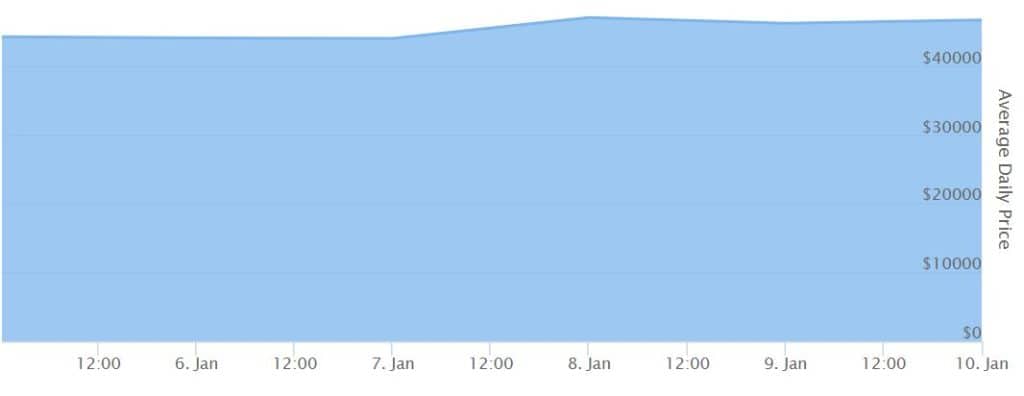

After the approval, Bitcoin’s price briefly surged to $47,000 but then quickly fell back, trading below $46,000 on Thursday morning. Experts believe the news of the Bitcoin ETFs’ arrival had already been factored into the price.

On Tuesday, Bitcoin momentarily surged towards $48,000. This increase followed a false report on X, claiming the SEC had approved the Bitcoin ETFs. After the SEC soon clarified that this statement was incorrect, Bitcoin’s price fell back to around $45,000. Partly due to optimism about the potential introduction of exchange-traded Bitcoin funds, the cryptocurrency had already risen in value by about 160 percent over the past year.

Standard Chartered analysts earlier had said that the ETFs could draw $50bn to $100bn this year alone, potentially driving the price of bitcoin as high as $100,000. Others have said inflows will be closer to $55bn over five years.

Let’s see what the future brings.

The post No surge Bitcoin price after SEC approval exchange-traded Bitcoin funds first appeared on Crypto Beat News.

Since you’re here …

… we have a small favour to ask. More people are reading Side-Line Magazine than ever but advertising revenues across the media are falling fast. Unlike many news organisations, we haven’t put up a paywall – we want to keep our journalism as open as we can - and we refuse to add annoying advertising. So you can see why we need to ask for your help.

Side-Line’s independent journalism takes a lot of time, money and hard work to produce. But we do it because we want to push the artists we like and who are equally fighting to survive.

If everyone who reads our reporting, who likes it, helps fund it, our future would be much more secure. For as little as 5 US$, you can support Side-Line Magazine – and it only takes a minute. Thank you.

The donations are safely powered by Paypal.